Rents Predicted to Rise in 2023. Great Time to Lock Down Housing Costs with Homeownership

If you rent, you probably have to make a big decision every year: do you keep the same lease, start a new one, or buy a home? This year is the same. But before you get too deep into your choices, it helps to know how much renting really costs.

Based on information from realtor.com, both current renters and new renters have seen their rent go up in the past year: “Three out of every four renters (74.2% of those who moved in the past year) said that their rent went up. New renters aren’t the only ones who are having a hard time because of recent rent hikes. Nearly two-thirds of renters (63.2% of those who have lived in their current rental between 12 and 24 months and likely renewed their lease) have also reported rent increases.

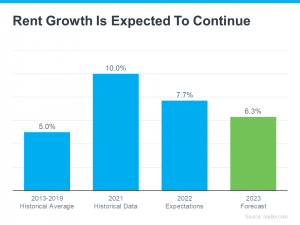

And if you look at the past, you shouldn’t be surprised by that. The Census says that rents have been going up pretty steadily since 1988 (see graph below): So, if you’re thinking about renting in 2023, you should think about whether this trend is likely to keep going. (See Census graph below.)

This prediction says that rents will go up by 6.3% in the coming year (shown in green). When you look at the blue bars on the graph, it’s clear that the 2023 projection doesn’t call for an increase as big as the ones renters have seen in the past two years, but it’s still higher than the average rent increase between 2013 and 2019.

So, if you want to rent again this year but haven’t renewed your lease yet, you may have to pay more when you do.

Rents are going up, but buying a home is an alternative

With prices going up, you may want to think about what other options you have. If you want more stability, you might want to put buying a home at the top of your list. One of the many benefits of owning your own home is that you can lock in a stable monthly payment for as long as your loan lasts.

Your monthly rent payments may go up over time, but with a fixed-rate mortgage, you’ll always pay the same amount. With a fixed-rate mortgage, your interest rate won’t change as long as you have the loan. Steady payments let you plan for the future and make good use of your money.

If you plan to move this year, locking in your monthly housing costs for the length of your loan can be a big help. You won’t have to worry about whether you need to change your budget to account for annual increases, like you would if you left your housing payment up to your landlord and their renewal cycle.

Homeowners also have a lot more equity in their homes, which has grown a lot. In fact, CoreLogic’s most recent Homeowner Equity Insight report shows that the average homeowner gained $34,300 in equity over the past year. As a renter, the money you pay goes only toward the cost of your home. When you pay your mortgage on a house, you automatically save money, which adds to your wealth. This is called your home equity.

Bottom Line

If you want to rent this year, it’s important to think about how much it will really cost you. Let’s talk about how you can start getting ready to buy a home today. Send me an email maryb@erakey.net or call/text 978-866-2091.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link